by Tori VanCura-Rutland, HC3 Chief Growth Officer

Banks and credit unions can find signing contracts with core providers nerve-racking. Having an agreement for the fundamental systems supporting banking operations is crucial for business survival; however, the experience can be overwhelming. Because of this, many financial institutions fail to secure the contract terms that will help their organization flourish in the long term.

While banks and credit unions rightly prioritize risk mitigation, especially regarding compliance and stability, they can achieve this through core provider contracts without sacrificing additional benefits. Often overlooked is the potential for these contracts to not only satisfy all compliance needs - protection from risk - but also offer significant advantages beyond mere risk reduction.

You can transform your ability to manage statement production with the right conversations during contract negotiations. You can avoid hidden costs, excessive data access limitations, and a lack of control over third-party vendors' use. When you address these issues with core providers, you begin the process of getting the agreement your business needs to succeed and truly transform.

Key Contract Issues

Before sitting down to discuss the future with your core provider, spend some time thinking about these vital points:

- Date accessibility - It can come as a shock to learn that contracts can stipulate that the core provider owns your data. In contract negotiations, you need to discuss data accessibility. Ensure that you have unrestricted access to raw statement files and that the data is available in a standardized format. Core providers might use proprietary formats for data and then charge you for converting the data to a standardized format. This is an example of a hidden cost that needs to be exposed before the contract is signed.

- Use of third-party vendors - Using third-party vendors, such as HC3 for statement production, can involve several contract issues that need to be discussed. Will the core provider make it possible to generate statement and notice data for third-party vendors? If you start using the core provider, but later decide to switch to a statement vendor, how will they support your efforts to make this transition? In general, what support will they offer for ongoing technology integrations? This is another place where pricing transparency is critical. Be sure to define all cost structures clearly so there are no hidden fees for switching vendors to address your changing needs.

- Statement production guarantees - Discuss contingency plans that come into play if the core provider experiences a disaster and cannot deliver statements on time. You require disaster recovery independence. This means you have the right to engage an external print vendor if the core provider cannot meet the deadline. This should be written into the service level agreement.

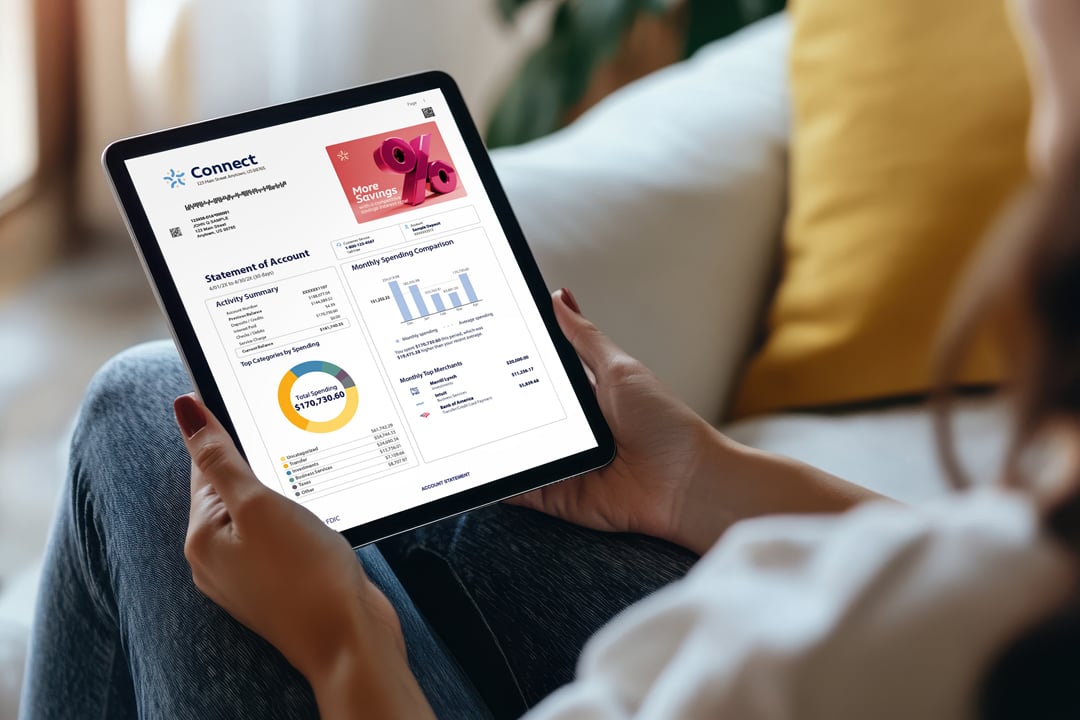

- Custom design and marketing control - The look of content is an essential component of your marketing strategy. Make sure your core provider contract does not impose limitations on the design of your statements or documents. You want to sign a contract that allows you to maintain creative control over your brand.

Help Is Available

When you face a contract renewal with your core provider, HC3 can help. We can assist with benchmarking your contract terms against industry best practices. We have experience working with banks and credit unions on these matters, and we can connect you with financial institutions that were able to secure flexibility in their contracts. Don’t hesitate to contact us to discuss how to structure your contract for long-term agility and operational control.

.png?width=1344&height=350&name=HC3%20Logo%20(Blue).png)