How Account Statements Can Drive Engagement and Growth

by Lee Long, HC3 Chief Experience Officer

Financial institutions operate under a staggering number of regulatory imperatives from state and federal authorities.

The perpetually-mailed, rarely read account statement is one of these, thanks to Regulation E, the Truth In Savings Act, and Regulation DD -- a fact that would surprise many consumers, given the number of people who receive a paper statement in the mail only to throw it in the trash. In some cases, they might save it under the conviction that it might be important, but statements are mostly only ever thought about when they’re needed, like when applying for a mortgage.

Today, very few consumers rely on a balanced checkbook or paper statement to stay up to speed with their finances. They’re using their mobile or online banking app to check balances and transactions in real-time. Even when they do need past statements for loan applications, many will simply download them from their digital bank account.

Meanwhile, banks keep stuffing envelopes and emailing monthly statements – a herculean task with seemingly dubious value for the consumer.

But it doesn’t have to be that way. The requirement to provide monthly or quarterly statements isn’t going away soon.

What if financial institutions could repurpose the traditional statement into a mechanism for increased engagement and, dare we say it, delight?

Transforming an Obligation into an Opportunity

According to research released by Cornerstone Advisors in their 'What’s Going On In Banking 2025' report, and echoed by American Banker, the majority of institutions are planning to increase their technology expenditures in 2025 – with nearly seven out of 10 respondents saying they plan on spending as much as 10% more than in 2024.

Cornerstone’s report showed the majority of these investments are earmarked for account opening platforms (commercial and consumer) as well as Fraud, BSA (Bank Secrecy Act), and AML(Anti-Money Laundering) improvements.

Account statements were nowhere to be found on the list of projected tech investments. That’s not a surprise because few institutions realize that their obligation to send statements is an opportunity waiting to be capitalized on.

For some institutions, a suggestion like that conjures thoughts of e-statement activation campaigns and postage savings – nothing to get excited about.

But they’re missing out.

Delivering More than an Account Statement

The intent of a statement is to create a regular source of transparency and accountability with consumers. After all, they’re trusting the institution to hold, manage, and move their money digitally. An account statement is an excellent way to record and report activity.

What if it could be more than that?

What if a monthly paper or e-statement could be a value-added service that improves financial well-being and account holder engagement? Consumers may check account balances on their phones, but that doesn’t mean they’re gaining a deep understanding of their financial situation.

Institutions aren’t going to cease statements any time soon. Here are just some of the possibilities for taking account statements from due diligence to delightful communication:

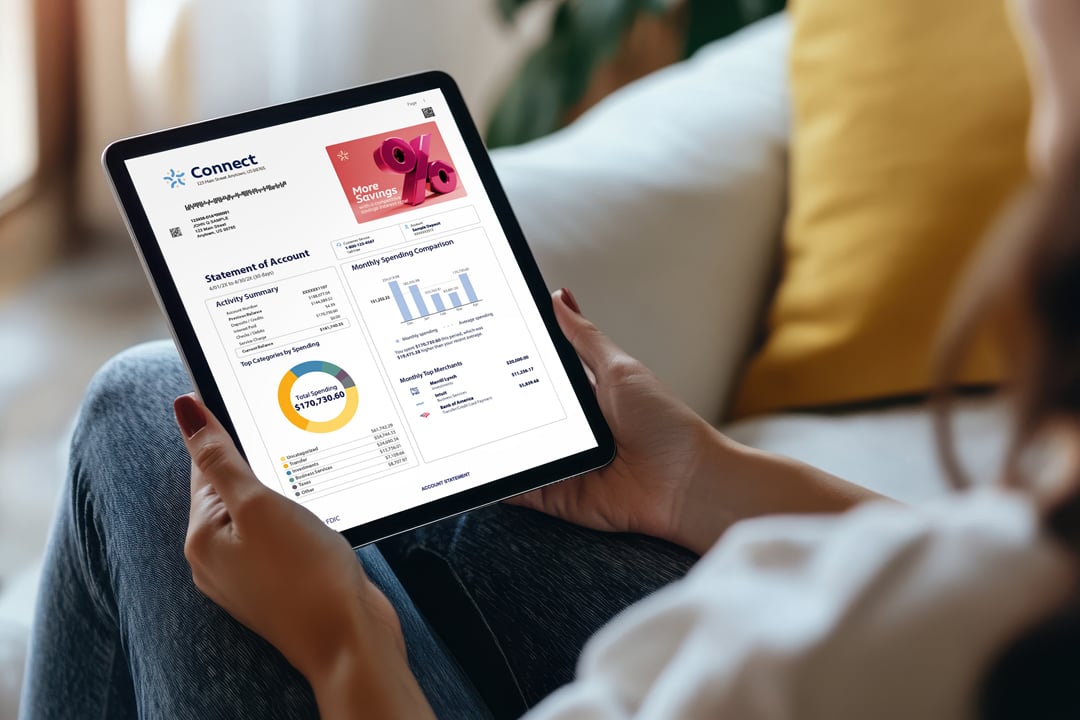

- Using API-enabled analytics, institutions can add customized reporting to help consumers better understand their spending patterns.

- By layering in additional data, your institution can also make personalized recommendations about financial products, services, and opportunities to save money.

- You can also use statements as a way to coach consumers toward their financial goals, with updated goal-tracking and educational call-outs.

- Marketing teams can leverage the statement process for marketing campaigns and special offers, taking advantage of whitespace more effectively.

Instead of a piece of glorified junk mail, an account statement can and should be a point of connection where your institution demonstrates knowledge of their needs and goals – expanding your role as a trusted partner on their financial journey.

Doing More with Less Effort

We’re not suggesting that by adding fancy graphics, pie charts, and finance tips, consumers will tear open their monthly statements and pour over the contents. However, as consumers migrate more of their financial lives to the digital realm, the importance of creating meaningful connections only grows more important. Consumers still want to know that their financial institution is more than an ATM, piggy bank, and AI chatbot. Financial visibility can be a stepping stone to their dreams and ambitions for the future. A thoughtful, well-designed statement might be exactly what they need to make progress.

.png?width=1344&height=350&name=HC3%20Logo%20(Blue).png)